The Plastics Sector in the GCC Countries

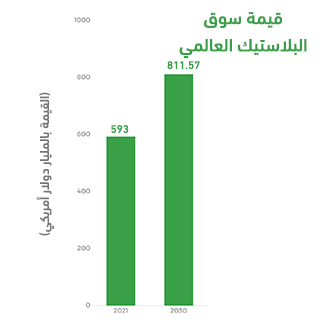

In 2020, the global plastics market was valued at approximately USD 579.7 billion, and it is expected to reach USD 750.1 billion by 2028, with a compound annual growth rate (CAGR) of 3.4%.

In the Gulf Cooperation Council (GCC) region, the plastics industry has grown significantly over recent decades, driven by government efforts to diversify economies and reduce dependence on oil and gas as sole sources of income.

Moreover, the rising demand for plastic in various industries—such as automotive, packaging, construction, and water piping—has been a key driver behind the growth of this vital sector. A report by the Gulf Petrochemicals and Chemicals Association (GPCA) highlighted that plastics represent the second-largest industrial sector in the region, with products valued at around USD 108 billion.

For those seeking a closer look at industry indicators in the Kingdom of Saudi Arabia, “Mashroo3k” presents key data points that can serve as a guide for your investment journey, based on the most recent available statistics:

-

Saudi Arabia accounts for approximately 72% of total plastic production in the GCC, while the region as a whole contributes 9% to global plastics manufacturing.

-

The Kingdom ranks 8th globally in plastics production and holds a 2% share of global polymer output.

-

As of the end of Q2 2021, there were over 222 rubber and plastics factories in Saudi Arabia, representing 11.9% of all operational factories in the Kingdom.

-

According to the Harmonized System (HS) classification, Saudi exports in the category of “Plastics in primary forms” were valued at SAR 67.824 billion, with a volume of approximately 16,978 tons. Exports in the “Non-primary plastic forms” category were valued at SAR 2.403 billion, with a volume of 384 tons.

-

In Q2 2020, the total value of plastic and rubber product exports was estimated at SAR 13.723 billion, increasing to SAR 22.491 billion by Q2 2021.

-

The operational expenditures of rubber and plastic product manufacturing activities currently exceed SAR 10.103 billion, while total revenues from these activities have reached SAR 20.149 billion.

-

By 2027, operating expenses in the rubber and plastic manufacturing sector are projected to rise to SAR 20.264 billion, with revenues expected to reach SAR 32.478 billion. This indicates a projected expense growth rate of 8% and a revenue growth rate of 5.4%.

In conclusion, “Mashroo3k” affirms that global demand for plastic is expected to triple by 2050. The available data also highlights the high level of plastic consumption per capita in the GCC region, with the latest statistics indicating that the average annual plastic consumption per individual is estimated at 94 kg.