“Mashroo3k ” Consulting Company offers a feasibility study for a compressed wood factory project in Egypt, with the highest profit returns and the best payback period. This is achieved through a series of detailed studies on the Egyptian market size, analysis of strategies from local and foreign competitors, and offering competitive price proposals.

The compressed wood factory relies on palm fronds, firewood, and other wood waste as raw materials. Compressed wood is known for being affordable and widely used in kitchens and interior decorations. Egypt is considered a promising market for compressed wood products.

“Mashroo3k” Consulting Company offers investors interested in establishing a compressed wood factory in Egypt a set of specialized feasibility studies based on updated databases specific to the Egyptian market, helping ensure the success of the project, achieve the highest profitability, and secure the best payback period.

Products with the highest quality standards.

Implementation of accredited quality standards.

Adherence to approved health regulations.

Management of development and marketing ideas to enhance competitive advantages.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

Recycling Sector in the GCC Countries

The technological advancements in the GCC countries, along with population growth, have contributed to an increase in the amount of waste generated from human and industrial activities, among others. This waste has posed a real challenge for the governments of the GCC countries, as they must now deal with it more rapidly to avoid environmental and health problems. The total amount of collected waste (hazardous and non-hazardous) in the GCC countries has been estimated at approximately 131.8 million tons, with this waste divided as follows: (1.2% hazardous waste) and (98.8% non-hazardous waste).

“Mashroo3k” Economic and Administrative Consulting Company would like to present the following key indicators of the recycling sector in the GCC countries:

The total amount of hazardous waste collected in the GCC countries is 1.6 million tons.

2 million tons is the total amount of non-hazardous waste in the GCC countries.

The collected hazardous waste is divided into: (6% medical waste), (81.8% industrial waste), and (12.2% other waste, such as batteries and electronic waste).

The collected non-hazardous waste is divided into: (40.7% construction waste), (25% household waste), (1.7% green waste), and (32.5% other waste).

The amount of waste processed from the total collected waste is 51% (67.2 million tons).

The amount of industrial waste collected in the GCC countries is 1.3 million tons. It is noteworthy that Saudi Arabia and the UAE together produce 63.1% and 19.3%, respectively, of the total industrial waste.

The amount of non-hazardous waste collected from the household sector in the GCC countries is 32 million tons.

The UAE ranks first in the amount of waste processed by recycling, at 42.8%.

The amount of recycled hazardous waste in the GCC countries is 100,000 tons (9.3%) of the total processed hazardous waste.

Saudi Arabia leads in the volume of solid waste with more than 16 million tons annually, followed by the UAE with approximately 5.4 million tons annually.

Waste Division in the MENA Region:

Food and green waste: 58%

Glass: 3%

Metals: 3%

Paper and cardboard: 13%

Plastics: 12%

Wood: 1%

Rubber and leather: 2%

Other waste: 8%

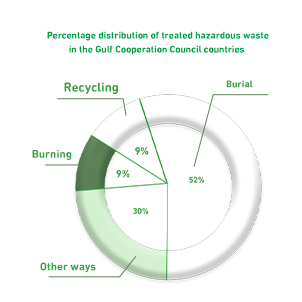

In the GCC countries, hazardous waste is treated by incineration (9%), landfilling (51.7%), and recycling (9.3%), while other methods account for the remaining percentage (30%). Non-hazardous waste is treated through landfilling (51%), with other methods such as incineration, recycling, and others accounting for 49%.

Advantages of the Circular Economy in the GCC Countries:

Reducing primary energy consumption by approximately 4%.

Creating 50,000 jobs in the recycling sector.

Reducing CO2 emissions by 13 million tons annually.

Contributing to economic returns of up to 138 billion USD for the GCC countries between 2020 and 2030.

Recommendations:

“Mashroo3k” recommends investing in the recycling sector due to the following:

The world generates approximately 2.01 billion tons of municipal solid waste, and this figure is expected to rise to 3.40 billion tons by 2050.

In 2014, global electronic waste production reached 12.8 million metric tons, and this number increased to 53.6 million metric tons by 2019.

Plastics and paper account for about 29% of total global waste, making them promising sectors for profit if invested in through recycling.

“Mashroo3k “ confirms that the volume of waste in Saudi Arabia now exceeds 45 million tons annually. Given that the Kingdom is determined to increase the recycling rate from 1% to 80% by 2035, the company believes that investing in this vital sector will be highly profitable. Regarding the prospects of the recycling and energy industry, we can mention the following:

In Saudi Arabia, we can save 45,000 terajoules of energy by recycling only glass and metals.

We can generate 3 terawatt-hours of electricity annually if all food waste in Saudi Arabia is used in biogas plants.

We can generate electricity in Saudi Arabia amounting to 1 to 1.6 terawatt-hours annually if plastic and other mixed waste (such as paper, cardboard, wood, textiles, leather, etc.) are processed in pyrolysis operations.

“Mashroo3k “ Economic Consulting and Market Research Company confirms that recycling is one of the promising sectors in Saudi Arabia. Its projects will be genuine investment opportunities, especially after Saudi Arabia has shifted toward a green economy. Environmental conservation has become a top priority for the wise leadership, as clearly reflected in Vision 2030.

Global Recycling Sector

The global waste management market was valued at approximately 989.20 billion USD in 2021, and it is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2022 to 2030. By the end of the forecast period, the market value will reach 1,685.5 billion USD. The Middle East and North Africa (MENA) region is expected to expand in recycling and waste management at a CAGR of 6.3% during the period from 2022 to 2030. This growth is attributed to the increasing awareness of the sustainable benefits of waste reuse and recycling. Furthermore, the growing population, urbanization, economic growth, and consumption patterns require encouragement to invest in this vital sector.