Mashroo3k Consulting Company offers a feasibility study for an entertainment gaming hall project in Egypt, ensuring the highest profitability and the best payback period. This is achieved through detailed studies of the Egyptian market size, analysis of local and international competitors’ strategies, and providing competitive pricing offers.

The entertainment game hall includes billiards and snooker tables, a bowling alley, as well as a variety of other electronic services that support artificial intelligence technologies and interactive gameplay methods suitable for all age groups, from children to young adults. The youth and girls’ segments are among the primary targets of the entertainment game hall, with its diverse recreational offerings. Mashroo3k Consulting Company provides investors interested in investing in an entertainment game hall project in Egypt with a set of specialized feasibility studies, based on updated databases specific to the Egyptian market. This ensures the success of the project, achieving the highest profitability and the best payback period.

Services of the highest quality.

Implementation of approved quality standards.

Adherence to approved health regulations.

Management of development and marketing ideas to enhance competitive advantages.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

In light of Mashroo3k Consulting Company’s belief in the role of the entertainment sector in building non-oil economies, we present below the key indicators for the sector in the GCC countries:

According to the latest statistics, the number of museums in the GCC countries stands at 306 museums, with a total of 6,032,840 visitors.

The number of hotel establishments in the GCC is 11,119.

In the Kingdom of Saudi Arabia:

The number of entertainment events reached 690, totaling 9,784 days. The number of attendees at these events was 34,699,458 individuals.

There are 33 museums of archaeology, history, and heritage.

The number of private museums is 195.

There are 8,499 archaeological sites, with 178,020 annual visitor permits issued.

The entertainment sector is expected to contribute 4.2% to Saudi Arabia’s GDP in the coming years.

In the United Arab Emirates:

The latest statistics show that the UAE has 41 museums, with 2,322,807 visitors.

There are 260 public parks.

In the Sultanate of Oman:

The country has 12 museums, with over 408,000 visitors.

Oman also has 51 forts and castles, which attract 427,000 visitors.

In Qatar:

Qatar has 291 sports facilities, with the majority being football fields (90 stadiums) and covered halls (37 halls).

The country has 99 cinemas, with a total seating capacity of 14,108. The number of films shown at these cinemas, according to the latest statistics, is 3,549.

The total annual visitors to museums and exhibitions in Qatar is 1,038,470.

In Kuwait:

The number of visitors to the Kuwaiti Tourist Projects Company, which offers many recreational services, reached 1,308,514.

The number of museum visitors in Kuwait is 108,987.

There are 814 libraries in Kuwait, with over 2,087,513 books cataloged.

The governments of the GCC countries are striving to improve the quality of life and provide a high level of well-being for their citizens by investing in the entertainment sector. In recent years, we have seen how these governments have adopted initiatives aimed at increasing the number of parks, live entertainment shows, and encouraging visual and auditory arts.

The entertainment and hospitality construction market in the GCC is expected to reach USD 642.3 billion by 2023, compared to USD 466.9 billion in 2019. According to the United Nations World Tourism Organization, the GCC countries are poised to welcome 195 million visitors by 2030.

Global Entertainment Sector:

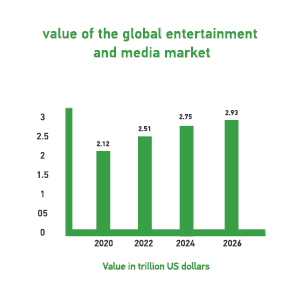

In 2021, the global entertainment and media market was valued at USD 2.34 trillion, and it is expected to grow at a compound annual growth rate (CAGR) of 4.6%, reaching USD 2.93 trillion by 2026.

Mashroo3k Consulting Company recommends investing in the entertainment sector due to the following reasons:

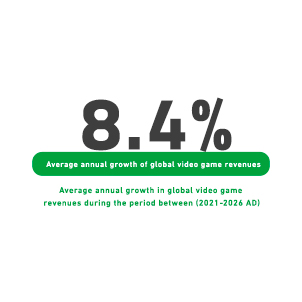

In 2021, global video game revenues totaled USD 214.2 billion, and these revenues are expected to rise to USD 321.1 billion.

Global cinema revenues are projected to grow at an average of 20.4% between 2021 and 2026.

According to Citibank forecasts, the metaverse investment opportunities are expected to reach USD 13 trillion by 2030.

Global spending on Virtual Reality (VR) increased by 36.5% in 2021, reaching USD 2.6 billion. This spending is expected to grow at a compound annual growth rate (CAGR) of 24.1% between 2021 and 2026, reaching USD 7.6 billion.

The average annual growth rate for console game revenues is projected to be 2.2% between 2021 and 2026.

The average annual growth rate for computer game revenues is expected to be 4.6% between 2021 and 2026.