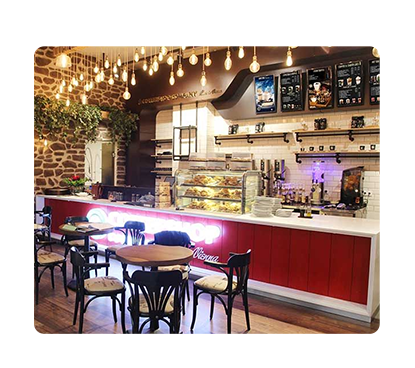

A coffee shop project is a unique investment idea aimed at providing a comfortable and complete experience for customers from various demographics. The project offers a wide variety of hot beverages such as coffee and tea in different types, in addition to cold and carbonated drinks that satisfy all tastes. It also provides a rich selection of delicious desserts and fresh baked goods that add extra value to the customer experience. Additionally, the coffee shop features a carefully selected menu of light meals to meet the needs of customers looking for a quick and nutritious bite. The coffee shop is distinguished by its high-quality services while maintaining competitive prices, making it easy to attract a broad customer base. The success of the project is supported by several important factors, including a strategic location that ensures easy accessibility, attractive décor that creates a comfortable and relaxing environment, and the efficiency of the staff focused on delivering the best customer experience. Furthermore, the coffee shop offers additional services such as free Wi-Fi, making it an ideal destination for studying, working, and social events.

A coffee shop project is an attractive investment that combines offering hot and cold beverages, along with light dishes such as desserts and specialty chocolates, making it the perfect destination for a variety of customers, including university students, families, business professionals, and others. The project features a modern design that blends comfort and functionality, creating an ideal environment for relaxation or focusing on work and study. The project’s prime location ensures easy customer access and allows them to enjoy a unique experience in an inviting atmosphere. Managed by a professional team, the project guarantees exceptional service that meets all customer expectations. Additionally, its competitive pricing makes it accessible to all demographics. Mashroo3k Consulting Company provides comprehensive services to support investors wishing to launch a coffee shop project, starting with preparing a detailed economic feasibility study and extending to logistical support and supplying operational needs for the project. Don’t hesitate to request a feasibility study from our experts to ensure the project’s success and long-term profitability.

Prime location, easily accessible.

High-quality products and services.

Competitive pricing.

Highly experienced staff.

Designated areas for business professionals.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

In light of Mashroo3k Consulting Company’s belief in the role of the entertainment sector in building non-oil economies, we present below the key indicators for the sector in the GCC countries:

According to the latest statistics, the number of museums in the GCC countries stands at 306 museums, with a total of 6,032,840 visitors.

The number of hotel establishments in the GCC is 11,119.

In the Kingdom of Saudi Arabia:

The number of entertainment events reached 690, totaling 9,784 days. The number of attendees at these events was 34,699,458 individuals.

There are 33 museums of archaeology, history, and heritage.

The number of private museums is 195.

There are 8,499 archaeological sites, with 178,020 annual visitor permits issued.

The entertainment sector is expected to contribute 4.2% to Saudi Arabia’s GDP in the coming years.

In the United Arab Emirates:

The latest statistics show that the UAE has 41 museums, with 2,322,807 visitors.

There are 260 public parks.

In the Sultanate of Oman:

The country has 12 museums, with over 408,000 visitors.

Oman also has 51 forts and castles, which attract 427,000 visitors.

In Qatar:

Qatar has 291 sports facilities, with the majority being football fields (90 stadiums) and covered halls (37 halls).

The country has 99 cinemas, with a total seating capacity of 14,108. The number of films shown at these cinemas, according to the latest statistics, is 3,549.

The total annual visitors to museums and exhibitions in Qatar is 1,038,470.

In Kuwait:

The number of visitors to the Kuwaiti Tourist Projects Company, which offers many recreational services, reached 1,308,514.

The number of museum visitors in Kuwait is 108,987.

There are 814 libraries in Kuwait, with over 2,087,513 books cataloged.

The governments of the GCC countries are striving to improve the quality of life and provide a high level of well-being for their citizens by investing in the entertainment sector. In recent years, we have seen how these governments have adopted initiatives aimed at increasing the number of parks, live entertainment shows, and encouraging visual and auditory arts.

The entertainment and hospitality construction market in the GCC is expected to reach USD 642.3 billion by 2023, compared to USD 466.9 billion in 2019. According to the United Nations World Tourism Organization, the GCC countries are poised to welcome 195 million visitors by 2030.

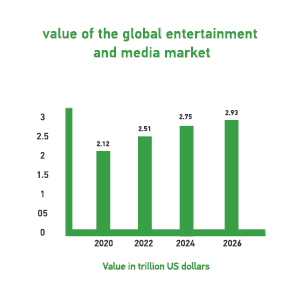

Global Entertainment Sector:

In 2021, the global entertainment and media market was valued at USD 2.34 trillion, and it is expected to grow at a compound annual growth rate (CAGR) of 4.6%, reaching USD 2.93 trillion by 2026.

Mashroo3k Consulting Company recommends investing in the entertainment sector due to the following reasons:

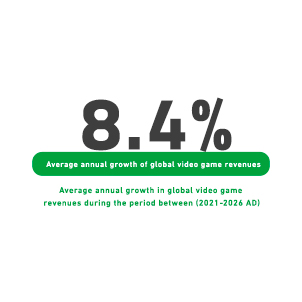

In 2021, global video game revenues totaled USD 214.2 billion, and these revenues are expected to rise to USD 321.1 billion.

Global cinema revenues are projected to grow at an average of 20.4% between 2021 and 2026.

According to Citibank forecasts, the metaverse investment opportunities are expected to reach USD 13 trillion by 2030.

Global spending on Virtual Reality (VR) increased by 36.5% in 2021, reaching USD 2.6 billion. This spending is expected to grow at a compound annual growth rate (CAGR) of 24.1% between 2021 and 2026, reaching USD 7.6 billion.

The average annual growth rate for console game revenues is projected to be 2.2% between 2021 and 2026.

The average annual growth rate for computer game revenues is expected to be 4.6% between 2021 and 2026.