Mashroo3k Consultancy offers a feasibility study for an autism care center project in Egypt, ensuring the highest profit returns and the best payback period. This is achieved through a series of detailed studies on the size of the Egyptian market, an analysis of competitors’ strategies, and offering competitive pricing proposals.

<strong>Autism Spectrum Disorder (ASD)</strong> is typically recognized as a condition that appears in children before the age of three. It affects how a child speaks, behaves, and interacts with others. There are various types of autism, and the symptoms can differ greatly from one child to another.<br>Given that autism is a very challenging and complex condition with no definitive cure, many parents turn to autism care centers, which provide specialized educational and therapeutic services for children with autism. These centers also offer rehabilitation programs aimed at helping children integrate into society and the workforce.<br>Mashroo3k offers investors interested in establishing autism care centers in Egypt a range of specialized feasibility studies based on up-to-date data for the Egyptian market. This ensures the success of the project, providing the highest profit returns and the best payback period.<br>

Collaboration between service providers, patients, and parents.

Providing services to everyone without discrimination.

Offering accredited educational programs.

Providing ongoing rehabilitation programs.

Providing specialized educational professionals.

Executive summary

Study project services/products

Market Size Analysis.

Mashroo3k Economic Consultancy has outlined some key indicators and important factors for anyone interested in investing in this sector and its projects within the GCC countries:

The total number of hospitals in the GCC countries is 802, according to the latest statistics. The public sector accounts for 58.9%, while the private sector accounts for 41.1% of the total number of hospitals.

More than 61% of the medical doctors in the GCC are located in Saudi Arabia.

Compared to the other GCC countries, the UAE has the highest percentage of medical doctors in the private sector, with 64%. Bahrain follows with 44.8%, and Qatar ranks third with 27.1%.

Compared to the other GCC countries, Kuwait has the highest percentage of medical doctors in the public sector, with 79%, followed by Oman with 74.6%, and Saudi Arabia with 71.6%.

In Saudi Arabia, the annual spending on digital healthcare infrastructure is expected to increase from $0.5 billion to $1.5 billion by 2030.

The GCC region has approximately 700 healthcare projects at various stages of development, valued at around $60.9 billion. These projects include hospitals, clinics, and research centers, with 264 projects valued at $24.7 billion currently under construction.

Through Mashroo3ak’s journey of supporting entrepreneurs and investors, the firm has deeply believed in the importance of the health sector and its pivotal role in the development of the economy and the advancement of nations. Based on this belief, Mashroo3ak has decided to share some important indicators and keys for those interested in investing in this sector and its projects within the GCC countries:

Healthcare spending in the GCC countries is expected to reach $104.6 billion in 2022, up from $76.1 billion in 2017.

The average healthcare inflation in the GCC countries is expected to decrease to 4% in the coming years.

Due to the expected rise in the number of patients, the GCC countries will require a clinical capacity of approximately 118,295 beds.

Artificial intelligence (AI) is expected to represent 30% of hospital investments in the GCC countries from 2023 until the end of 2030.

The pharmaceutical manufacturing market in the GCC is expected to grow, with its value ranging between $8 billion and $10 billion.

The consumer goods manufacturing market in the GCC will thrive from 2025 to 2030, with the market size expected to reach $30 billion.

According to United Nations reports, the global population is expected to reach 8.5 billion by 2030, and by 2050, it is estimated to increase to 9.7 billion. This population growth will undoubtedly lead to an increased demand for healthcare services. Therefore, Mashroo3k recommends investing in this vital sector.

It is also noted that global healthcare spending is expected to increase at a rate of 3.9% annually between 2020 and 2024, which is significantly higher than the 2.8% growth rate recorded between 2015 and 2019.

It is worth mentioning that the number of hospital beds worldwide is 2.9 beds per 1,000 people, and the number of doctors is 1.8 doctors per 1,000 people. Meanwhile, the number of nurses and midwives is 4 per 1,000 people. These numbers are significantly lower than required, and therefore, there is a need to increase investments in the healthcare sector to meet the growing demand for healthcare services.

Global Healthcare Sector:

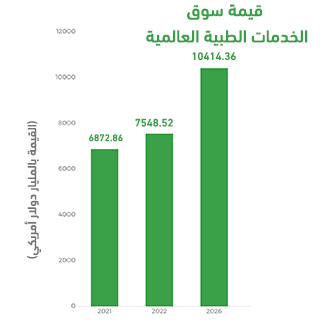

Technological advancements in the healthcare sector have played a key role in improving medical services. Survival rates and quality of life have greatly improved over the past decade. Experts predict that the global medical services market will grow from $6,872.86 billion by the end of 2021 to $7,548.52 billion by the end of 2022. By 2026, the medical services market is expected to experience significant growth, reaching a value of $10,414.36 billion, with a compound annual growth rate (CAGR) of 8.4% during the forecast period (2022–2026).