-

Products of the highest quality.

-

Application of approved quality standards.

-

Compliance with approved health regulations.

-

Management of developmental and marketing ideas to enhance competitive advantages.

mashroo3k Company Consulting provides a feasibility study for a contracting company project in Egypt, with the highest profit return and best payback period, through a series of precise studies on the size of the Egyptian market, analysis of local and foreign competitors’ strategies, and providing competitive price offers.

The project idea is based on establishing and preparing a major contracting company that offers engineering consultations and implements interior and exterior finishing services for various types and sizes of facilities. Construction and building projects in Egypt represent a promising investment future in the coming period, due to the continuous growth of the construction sector in Egypt and the rising of its developmental indicators. Your project consulting company provides interested investors with specialized feasibility studies based on updated databases specific to the Egyptian market, which helps ensure the project’s success, achieve the highest profit returns, and the best payback period. …

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

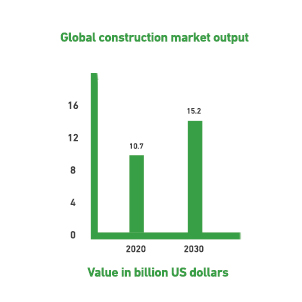

The construction sector contributes about 13% to the global GDP and this percentage is expected to rise to 13.5% by 2030. According to the statistics available to us, infrastructure will be at the top of the list of the fastest growing sub-sectors in the construction sector at a rate of 4% during the period (2020-2030).