- Products that meet international quality standards.

- Application of general transport and storage regulations.

- A management team with ambitious plans.

Mashroo3k Consulting offers a feasibility study for an import and export company project in Egypt, ensuring the highest profitability and optimal payback period. This is achieved through in-depth studies of the Egyptian market size, analysis of competitor strategies, and the provision of competitive pricing offers

The import and export company facilitates the supply of raw materials and various types of goods to the local market. It targets import and export companies, factories, trading and distribution companies, as well as wholesale and retail traders.<br>”Mashroo3k” Consulting provides investors interested in launching an import and export company in Egypt with a set of specialized feasibility studies, based on up-to-date databases specific to the Egyptian market. This support helps ensure the success of the project, achieve the highest possible profitability, and secure the best payback period.

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

Technical study

Financial study

Organizational and administrative study

The Service Sector in the GCC Countries

According to the macroeconomic theory of sectors, the economy is divided into three major sectors: the first sector, which focuses on collecting raw materials and includes mining companies, timber companies, oil exploration companies, agricultural industries, and fishing. The second sector relies on goods and their sale, such as car manufacturing, furniture, clothing trade, and so on. The third sector, known as the “service” sector, is responsible for providing and producing services, relying on intangible elements such as entertainment, healthcare, transportation, hospitality, restaurants, and more. This theory suggests that as countries progress, their economies tend to focus more on the third sector, unlike primitive nations which depend heavily on the first sector (for example, the service sector in the United States accounts for 85% of its GDP).

Saudi Arabia:

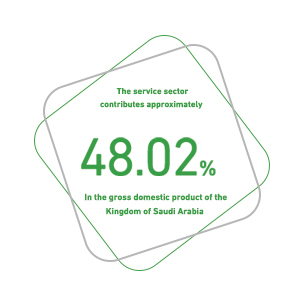

The service sector is considered a significant part of the economy, encompassing wholesale and retail trade, restaurants and hotels, transportation and storage, information and communications, financial services, insurance, real estate, business services, social and personal services, and government services. Below are some key indicators of the sector in Saudi Arabia:

The service sector contributes approximately 48.2% to the country’s GDP.

Wholesale, retail trade, restaurants, and hotels contribute 10.8% to GDP.

Transport, storage, information, and communications contribute 6.6% to GDP.

Financial services, insurance, real estate, and business services contribute 6.4% to GDP.

Social, collective, and personal services contribute 2.5% to GDP.

Government services contribute 21.9% to GDP.

In the previous year, Saudi Arabia issued 100,944 new commercial licenses, bringing the total number of commercial licenses issued to 348,173. Wholesale and retail trade and motor vehicle repair accounted for the largest share of new licenses, with 48,242 licenses, followed by accommodation and food services with 16,531 licenses, and construction activities with 11,521 licenses.

Qatar:

The wholesale and retail trade activity is valued at around 50,083 million Qatari Riyals.

There are 11,139 establishments working in wholesale and retail trade, employing 213,954 workers.

Compensation for workers in wholesale and retail trade is 11,288,877 thousand Qatari Riyals.

There are 2,396 establishments working in the hotel and restaurant sector, employing 78,194 workers.

Compensation for workers in the hotel and restaurant sector is 2,947,431 thousand Qatari Riyals.

The number of mobile phone subscribers in Qatar (regular subscription) is 976,015 individuals, while the number of prepaid mobile phone subscribers is 2,941,556 individuals.

The length of roads paved in the previous year in Qatar is 2,224 kilometers.

The number of driving licenses issued last year was 242,923.

Compensation for workers in the transportation and communications sector is 24,338,223 thousand Qatari Riyals.

The number of insurance policies issued in Qatar during the last year was 715,897.

There are 4,973 establishments in business services, employing 215,285 workers, with compensation for workers exceeding 15,347,819 thousand Qatari Riyals.

Workers in social and personal services in the private sector total 80,569, with compensation for these workers estimated at 6,127,645 thousand Qatari Riyals.

Kuwait:

Wholesale and retail trade contributes about 1,644.3 million Kuwaiti Dinars to the GDP.

Restaurants and hotels contribute about 418.6 million Kuwaiti Dinars to GDP.

Transportation, storage, and communications contribute about 2,554.5 million Kuwaiti Dinars.

The length of paved roads in Kuwait is 91,340,068 square meters.

United Arab Emirates:

Wholesale and retail trade, along with motor vehicle repair and motorcycle repair, contributes 12.3% to GDP (172,288 million AED).

Transportation and storage contribute 5.9% to GDP (82,461 million AED).

Accommodation and food services contribute 2.3% to GDP (32,357 million AED).

Information and communications contribute 2.9% to GDP (41,347 million AED).

Insurance and financial services contribute 9.6% to GDP (134,773 million AED).

The number of insurance policies issued was 7,584,607 at the end of the last year.

Wholesale and retail trade accounts for 13% of the total workforce in the UAE.

Transportation and storage account for 6.2% of the total workforce.

Around 5% of the total workforce works in accommodation and food services.

Oman:

The GDP of Oman is 29.3 billion Omani Rials.

Wholesale and retail trade contributes 7% to the GDP, amounting to 2,064.7 million Omani Rials.

Restaurants and hotels contribute 1.1% to GDP, amounting to 308.6 million Omani Rials.

Transportation, storage, and communications contribute 5.9% to GDP, amounting to 1,721.2 million Omani Rials.

Global Service Sector:

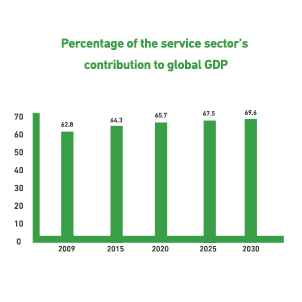

The service sector is the largest contributor to global GDP, making up more than three-fifths of the total output. Unlike sectors that produce tangible goods like automobiles or furniture, the service sector focuses on providing intangible services such as banking, healthcare, transportation, hospitality, entertainment, and more. In 2020, the global service sector market was valued at approximately 10,814.49 billion USD, and this value increased to 11,780.11 billion USD in 2021, with a compound annual growth rate (CAGR) of 8.9%. After recovering from the impact of the COVID-19 pandemic, market experts predict that the sector will reach a value of 15,683.84 billion USD by 2025, achieving a CAGR of 7% in the coming years.