Mashroo3k Consulting offers a comprehensive feasibility study for a Women’s and Maternity Center project in Egypt, designed to achieve maximum profitability and an optimal payback period. This is accomplished through detailed studies of the Egyptian market size, analysis of local and international competitors’ strategies, and the development of competitive pricing models.

The Women’s and Maternity Center aims to provide a full range of medical services in the field of obstetrics and gynecology, including ultrasound imaging, prenatal care, delivery services, and neonatal care, among others. The project will rely on an elite team of highly qualified medical professionals, enabling it to capture a significant market share shortly after launch.<br>Mashroo3k Consulting supports investors interested in establishing a Women’s and Maternity Center in Egypt by offering specialized feasibility studies based on up-to-date databases tailored to the Egyptian healthcare market. These studies are designed to ensure project success, maximize profitability, and achieve the best possible payback period.<br>

Executive summary

Study project services/products

Market Size Analysis

Risk Assessment

xecutive summary

دراسة خدمات / منتجات المشروع

Market Size Study

Risk study

Technical study

Financial study

Organizational and administrative study

The Healthcare Sector in GCC Countries

Key Indicators and Insights from Mashroo3k Consulting for Investors

Mashroo3k Consulting presents a set of vital indicators and key insights for anyone looking to invest in the healthcare sector and its projects across the GCC countries:

The total number of hospitals in the GCC stands at 802, according to the latest statistics. The public sector accounts for 58.9%, while the private sector represents 41.1% of the total.

Over 61% of general physicians are based in Saudi Arabia.

The UAE recorded the highest percentage of private sector physicians among GCC countries, at 64%, followed by Bahrain at 44.8%, and Qatar at 27.1%.

Kuwait has the highest percentage of government sector physicians at 79%, followed by Oman at 74.6% and Saudi Arabia at 71.6%.

In Saudi Arabia, annual spending on digital health infrastructure is expected to rise from $0.5 billion to $1.5 billion by 2030.

The GCC region currently has around 700 healthcare projects at various stages of development, valued at approximately $60.9 billion. These include hospitals, clinics, and research centers, with 264 projects worth $24.7 billion currently under construction.

Over the years, Mashroo3k has developed a deep belief in the critical role the healthcare sector plays in driving economic growth and uplifting nations. Rooted in this conviction, the company shares additional insights for those interested in investing in healthcare projects within the GCC:

Healthcare spending in the GCC is projected to reach $104.6 billion by 2022, up from $76.1 billion in 2017.

Average healthcare inflation across the GCC is expected to decline to 4% in the coming years.

Due to the anticipated increase in patient numbers, GCC countries will require a hospital bed capacity of approximately 118,295 beds.

Artificial Intelligence (AI) is forecasted to represent 30% of hospital investments in the GCC between 2023 and the end of 2030.

The pharmaceutical manufacturing market in the GCC is expected to grow to a value between $8 billion and $10 billion.

The medical consumables manufacturing sector is projected to flourish between 2025 and 2030, with an expected market size of $30 billion.

Global Healthcare Sector: A Strategic Investment Opportunity

According to United Nations reports, the global population is expected to reach 8.5 billion by 2030 and approximately 9.7 billion by 2050. This surge in population will inevitably lead to increased demand for healthcare services. Therefore, Mashroo3k strongly recommends investing in this vital sector.

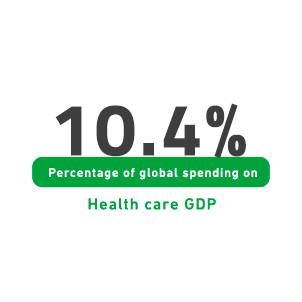

Global health expenditure is anticipated to grow at an annual rate of 3.9% between 2020 and 2024—significantly higher than the 2.8% growth rate recorded between 2015 and 2019.

It is worth noting that, globally, there are only 2.9 hospital beds per 1,000 people, and 1.8 physicians per 1,000 people. Meanwhile, the number of nurses and midwives stands at 4 per 1,000 people. These figures fall well below the actual need, highlighting the pressing demand for increased investment in the healthcare sector.

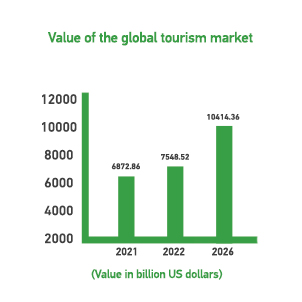

Technological advancements have played a pivotal role in improving healthcare services worldwide. Over the past decade, survival rates and quality of life have improved significantly. Experts forecast that the global healthcare services market will grow from USD 6,872.86 billion in 2021 to USD 7,548.52 billion by the end of 2022. By 2026, the market is expected to reach USD 10,414.36 billion, with a compound annual growth rate (CAGR) of 8.4% over the forecast period (2022–2026).