The project involves the establishment of a five-star desert tourist resort comprising 100 villas, each with a private pool. The project will feature a traditional mud-based design and will be divided into: (luxury villas with an area of 158 sqm – luxury villas with an area of 253 sqm – villas with an area of 253 sqm – museum – restaurant – reception hall – a private pool for each villa). The resort’s services include: (rental of luxury villas with an area of 158 sqm – rental of luxury villas with an area of 253 sqm – rental of villas with an area of 253 sqm – museum – two restaurants).

Mashroo3k Economic Consulting Company conducts a feasibility study for a desert tourist resort. From the analysis and study of the market size, it is evident that the tourism market—particularly desert tourism—is in great need of the services offered by the project, which include: rental of luxury villas with an area of 158 sqm, rental of luxury villas with an area of 253 sqm, rental of villas with an area of 253 sqm, a museum, and two restaurants. The resort also includes a reception hall, museum, and landscaped green areas.<br>The resort comprises 100 villas with an innovative traditional design that reflects the beauty of architectural arts, distributed into three categories: 70 luxury villas each with an area of 158 sqm, 15 traditional villas each with an area of 253 sqm, and 15 villas each with an area of 253 sqm. Each villa is equipped with a private swimming pool.<br>The project aims to create sustainable urban planning zones, attract visitors, and provide top-level services in accordance with international quality standards, at highly competitive prices. This is achieved through the support of outstanding and professional administrative and technical teams who will deliver services tailored to the target segments. The resort also aims to capitalize on the growing and expanding market demand.

Creating sustainable urban planning zones

Protecting and utilizing geological, topographical, and natural features

Establishing visitor attractions and providing the necessary services

Comprehensive development and enhancement of tourism services

Building distinctive recreational and aesthetic facilities according to advanced international standards and specifications

Providing a leisure outlet for residents and visitors

The resort includes 100 villas with an innovative traditional design that embodies the beauty of architectural arts, divided into three categories:

(70 traditional villas, each with an area of 158 sqm;

15 traditional villas, each with an area of 253 sqm;

15 villas, each with an area of 253 sqm)

Creating tourist attractions and ensuring the availability of essential services for tourists

Providing sufficient infrastructure to meet the needs of this project

Selecting architectural elements that reflect harmony and attractive, impactful design features

Maintaining the growth and stability of the services provided by the desert tourist resort project

Creating new investment opportunities with good returns

Ensuring a solid return for the project owner

Generating employment and improving the economic and social level of workers

Contributing to meeting part of the growing demand for tourism services

Executive summary

Study project services/products

Market Size Analysis.

The Tourism Sector in the GCC Countries

The tourism sector is one of the most significant contributors to global GDP. Its direct contribution accounts for 3.3% of total global GDP, while its overall contribution reaches 10.4%, amounting to USD 9.2 trillion. Moreover, tourism-related jobs represent 10.6% of all global employment, totaling approximately 334 million jobs. Global spending on leisure travel is estimated at around USD 2.37 trillion. It’s worth noting that tourism continues to grow steadily, creating one in every four new jobs worldwide. This provides a brief overview of global tourism indicators.

As for tourism indicators in the GCC countries, they are as follows:

The total number of international tourists arriving in the GCC countries reached 43.8 million, with an annual decline rate of 0.3% over a five-year period.

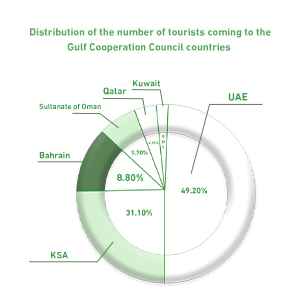

When expressed in percentages, the UAE alone accounted for approximately 49.2% of these arrivals, followed by Saudi Arabia with 31.1%. The chart below (not included here) shows the distribution of inbound tourists among the other GCC countries.

Spending by international tourists in the GCC has seen continuous growth, reaching USD 81.1 billion—an annual increase of 12.1%.

The UAE captured 47.3% of the total inbound tourist spending in the region.

Tourists spent a total of 303.2 million nights across the GCC, with Saudi Arabia accounting for 57.4% of those nights.

The number of intra-GCC tourists reached approximately 12.6 million people.

Intra-GCC tourism represented 28.7% of all inbound tourism to the region. Bahrain led in attracting these intra-GCC tourists, receiving 95.6% of its visitors from within the region.

According to a publication by the GCC Statistical Center, the total number of hotel establishments across the GCC stood at 11,119.

These establishments include a total of approximately 620,517 rooms, with a projected growth rate of 2.3%.

The leisure and hospitality construction market in the GCC is expected to reach USD 642.3 billion by 2023.

According to the United Nations World Tourism Organization (UNWTO), the GCC is projected to receive up to 195 million visitors by 2030.

لقطاع السياحي في دول مجلس التعاون الخليجي

يُعدُّ القطاع السياحي واحدًا من أهم القطاعات المساهمة في الناتج المحلي الإجمالي العالمي؛ فقد شكلت مساهمته المباشرة ما نسبته 3.3% من إجمالي الناتج المحلي العالمي؛ وعن مساهمة القطاع الإجمالية فقد بلغت نسبتها 10.4%؛ بواقع 9.2 تريليون دولار أمريكي. يذكر أن وظائف القطاع تمثل 10.6% من جميع الوظائف (334 مليون وظيفة)؛ وأن قيمة الإنفاق العالمي على السفر الترفيهي تقدر بنحو 2.37 تريليون دولار أمريكي. ونود التنويه هنا إلى أن القطاع يتنامى بشكل مستمر حتى إنه يخلق وظيفة من بين كل أربع وظائف جديدة في جميع أنحاء العالم. كانت هذه نبذة مختصرة عن مؤشرات القطاع العالمية

أما عن مؤشرات القطاع في دول مجلس التعاون الخليجي فسوف نعرضها فيما يلي:

There is no doubt that the COVID-19 pandemic had a significant impact on global travel and tourism indicators, with the sector’s contribution to global GDP dropping to just 6.1%, down from 10.3% the year before the pandemic. However, the sector has recently begun to recover, as confirmed by global indicators. For this reason, Mashroo3k Consulting recommends investing in this vital sector, based on the following:

According to the UN World Tourism Organization (UNWTO), the number of international tourists increased from 25.2 million in 1950 to 1.4 billion after 68 years.

By the end of 2021, 2,246 hotels were opened globally, and this number was expected to reach 2,805 hotels by the end of 2022, and 2,934 hotels by the end of 2023.

In 2021, 340,700 hotel rooms were opened worldwide, with projections indicating this number would rise to 428,000 rooms by the end of 2022, and to 447,600 rooms by 2023.

By the end of 2021, the global tourism sector’s contribution to GDP grew by 21.7% compared to the previous year, which had seen severe pandemic-related disruptions. The sector contributed approximately USD 5.81 trillion to global GDP.

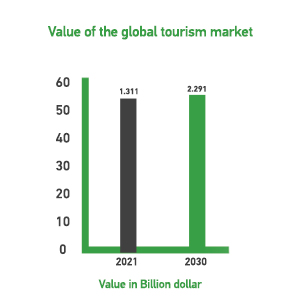

Additionally, the global tourism market was valued at USD 1.311 trillion, and it is expected to reach USD 2.291 trillion by 2030, excluding the pandemic’s effects.